3 Steps to Verify A Mortgage Broker or Lender’s license.

Verify a mortgage broker, a lender, or any financial service providers

Buying a home is one of the most (if not THE most) important financial decision that a person makes in a lifetime. The first step should NOT be searching the internet for available homes and looking at pictures for hours, it won’t help you at all. The first step should be getting pre-qualified by a lender, but be careful, which lender? should you go to “your bank”?

![]()

Make sure you get enough information before getting your credit pulled or you send sensitive information.

There are many lenders or mortgage brokers that call potential buyers offering their service. Unfortunately, there are many scammers who do the same. If you find a lender on the internet or someone call you with a financing offer, make sure you verify that person’s identity and that the company is legit before sending them any personal information and/or money.

Each time your credit is hit, your score is hurt as much as 8 to 10 points and scammers can use the information on your credit report to ruin your credit history and ability to obtain financing to buy a home or any other purchase you want to make.

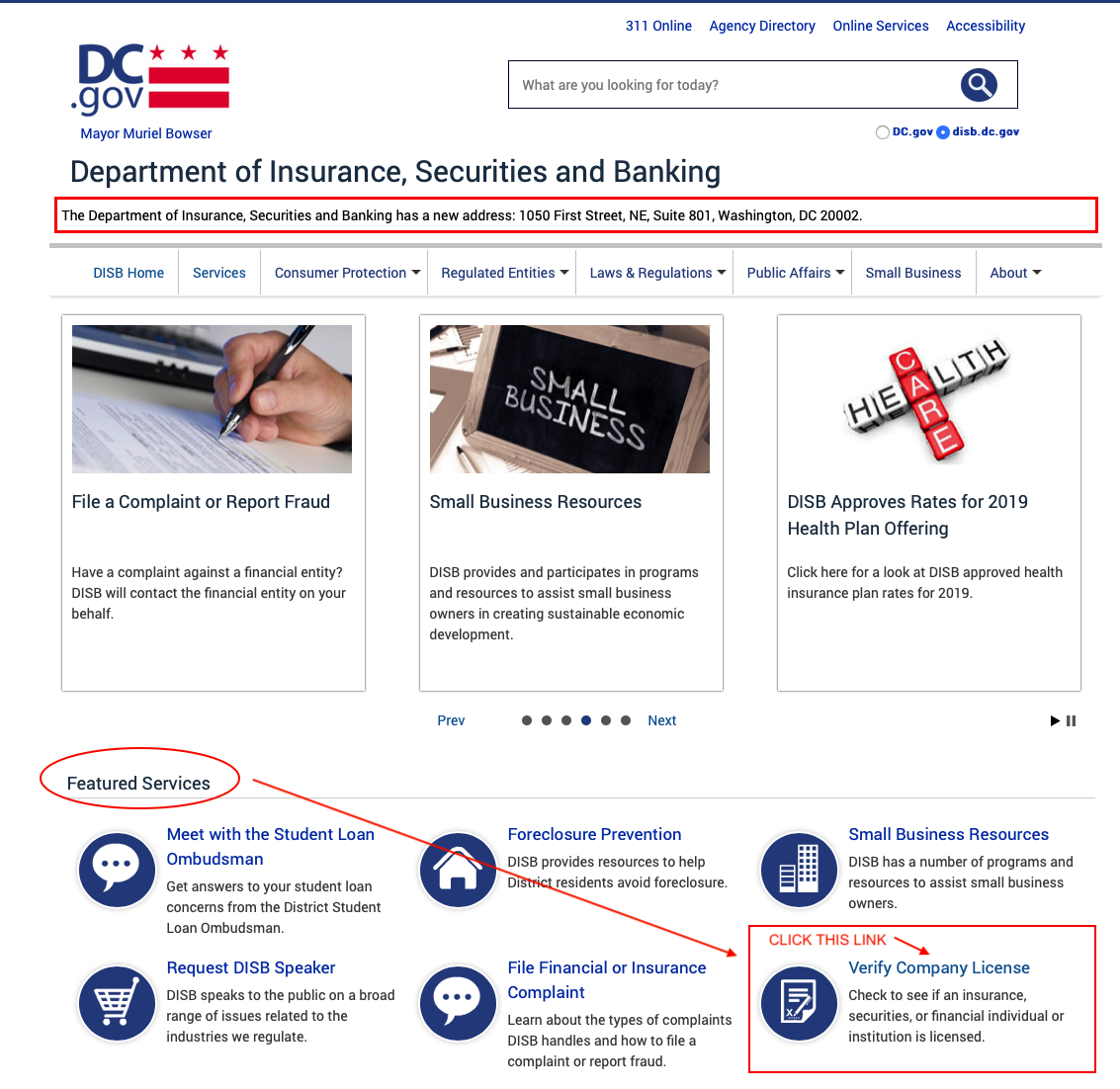

To verify a mortgage broker, lenders or any financial service provider follow these 3 simple steps at https://disb.dc.gov Note: ONLY governmental institutions are able to use .gov extensions on their domains.

STEP 1:

The Home page should look like this. Under Featured Services, click on Verify Company License

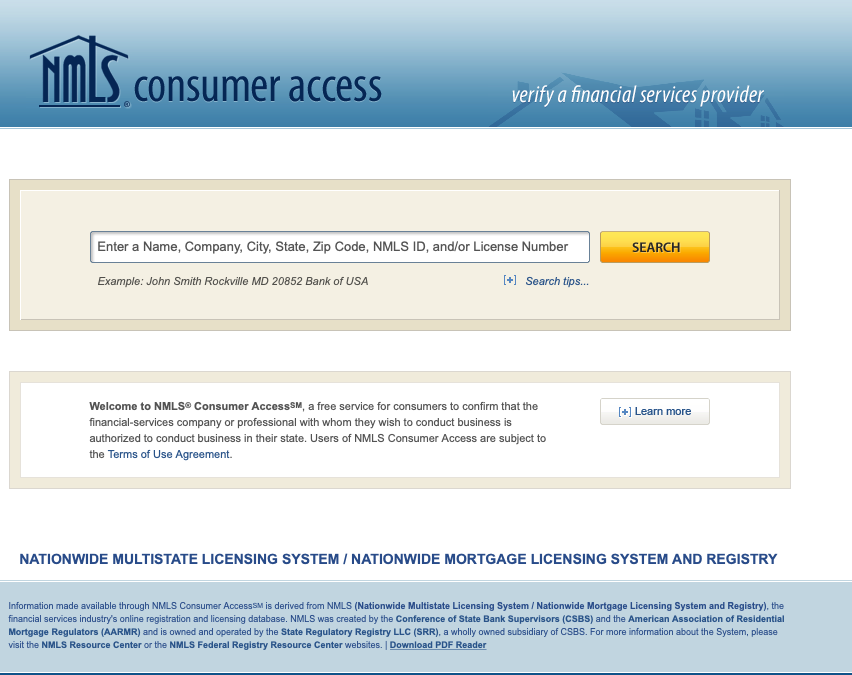

STEP 2:

Click the first link under Banks, Mortgages and Consumer Finance Institutions

STEP 3:

Verify a mortgage broker or lender’s license by entering the person’s name, Company, NMLS #, or license number and click Search

This is a simple and quick way to verify the mortgage broker or lender’s license and make sure you are dealing with a legit individual. Here you can also check if there have been complaints against the mortgage broker or lender. You should do this even is your friend, family member or real estate agent recommended the mortgage broker or lender. This is just one of the many questions to ask when buying a condo in Brickell, Miami. As I said before, buying a home is probably the biggest investment you will make in your life and you have to protect your investment.

Freddie Mac posted these simple tips to avoid being scammed:

- Be cautious with caller ID. Scammers can make any name or number appear from anywhere in the world.

- Let it go to voicemail. If a call from an unknown number is important, the caller will leave a message.

- Hang up. If it’s a robocall, don’t press any numbers. Just hang up.

- No information. Never give out personal, financial or other sensitive information − unless you have verified the caller as a legitimate source.

- Be suspicious. Be wary of offers that sound too good to be true. For example, Freddie Mac will never reach out to offer a refinancing opportunity or new loan over the phone.

- Report fraud. If you have been contacted by someone claiming to represent Freddie Mac or otherwise suspect fraud, report it here .

Once you are pre-approved for a loan by a licensed and verified mortgage broker or lender, it is time to search for homes available. If you are looking to buy a condo in Brickell Miami, there are lenders that can offer you financing with only 5% down payment or even better, there is something called FHA SPOT APPROVAL, which is a process to do an FHA loan (only 3.5% down payment) even if the Brickell building is not FHA approved.

Although it is not warranted, any Brickell building can qualify for an FHA SPOT APPROVAL. The lender has to evaluate the building’s financials, reserves, renters vs owner-occupied units ratios, among other things. If you are interested in more information about FHA SPOT APPROVAL program, you have to contact us right away. We can refer you to a licensed and verifiable mortgage broker who can assist you.

Brickell Miami Buildings to buy with only 5% Down Payment:

- 500 Brickell

- Mint

- Axis On Brickell

- Brickell Bay Club

- Costa Bella

- Courvoisier Courts

- Isola

- The Plaza On Brickell

- Brickell Ten Condo

- Skyline

- Villa Regina

- Neo Vertika

- The Vue at Brickell

- Wind by Neo