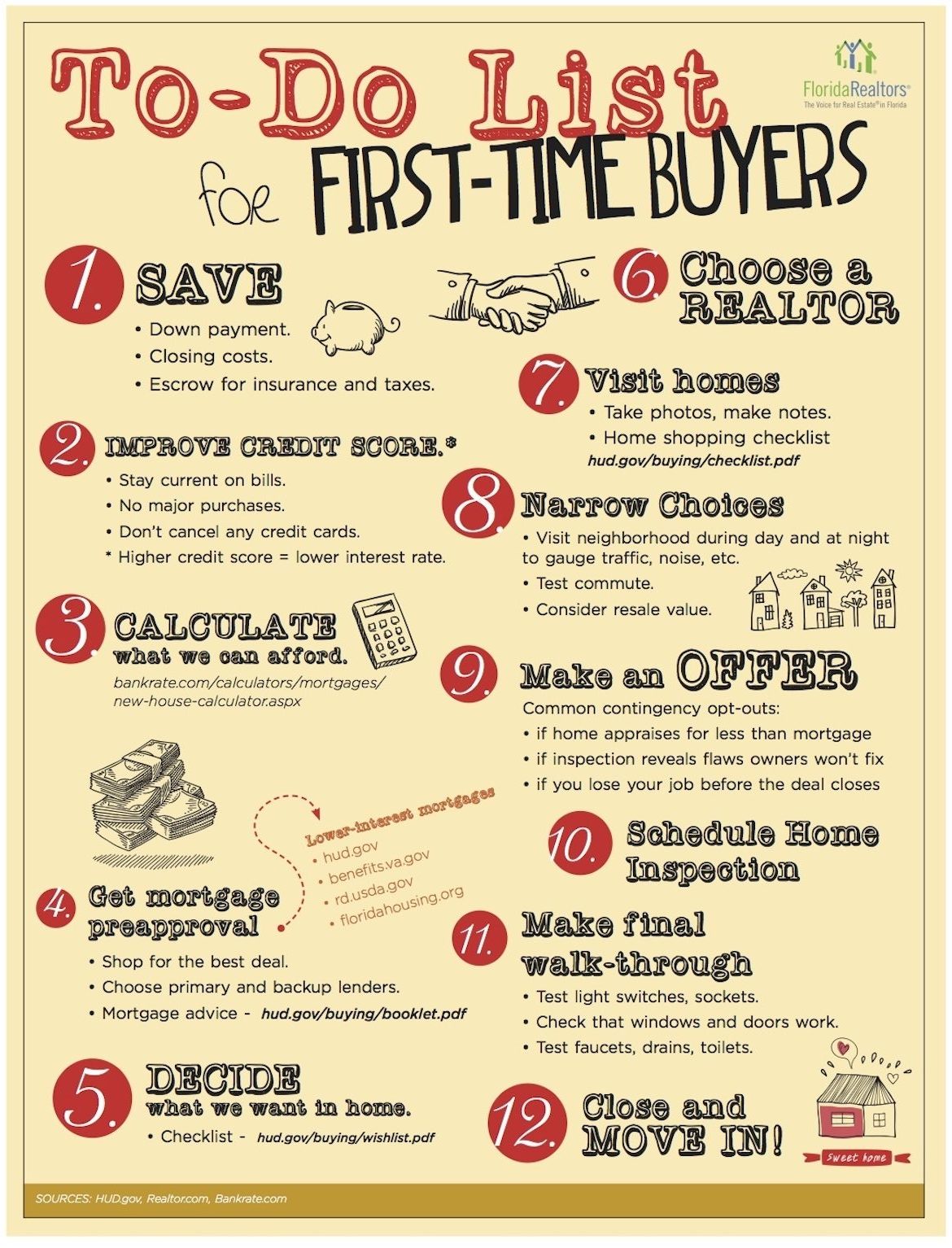

First Time Home Buyers Guide in 12 Steps

More often than not, first time home buyers get overwhelmed by all the information they are bombarded with even before they announce they are planning to buy a home. Everyone knows that once you enter “buying a condo” or “first time home buyer loan” in google, you will start receiving advertising in all social media channels and every website you visit. The right home for you is out there but are you ready for it?

1. Saving Money to Buy Your First Home

Everybody knows that to buy a property you will need money, but how much would it be needed to buy a condo in Brickell as a primary home?

Down Payment: Buying a home is a big commitment. As a first time home buyer, you better start saving money for the first expense that you are going to incur: the down payment. But do not panic, first-time home buyers can now opt for an FHA loan to buy a condo in Brickell. Only 3.5% down payment is required with the new FHA Spot Approval program or 5% to 30% for a conventional loan.

As an example, to purchase a $300,000 1 bedroom 1 bath condo in Brickell, Miami with 3.5% down payment, you will have to save $10,500 for the down payment. Of course, the less you put down, the higher your mortgage payment. Play with the numbers in the mortgage calculator on the right column →→

Closing Cost: Around 4% of the mortgage, it could change depending on your credit, if the lender charges points, etc.

Escrow for insurance and taxes: You must pay the lender a certain amount each month to cover property taxes, homeowners insurance, and private mortgage insurance. (These are collectively called “escrow items.”) The lender then pays for those items on your behalf as the bills come due.

Read more about condo financing here

2. Improve your credit score

Stay current on bills: Pay all the bills on time, do not be late. To qualify you, the lender looks at your monthly obligation, not to the total amount owed to the credit card. For example, you owe $5,000 to a creditor but your minimum monthly payment is $70, the lender will take the $70 as your monthly responsibility. It is important that you pay it before the due date.

No major purchases: If you are thinking of buying a condo in Brickell or other area in Miami, it is not recommended to buy a car or furniture, those debts are considered major and affect your credit score. Lenders pull credit reports before the closing to make sure the borrower’s financial situation has not changed since the loan was approved. Any new loans on your credit report can jeopardize the closing.

Do not cancel any credit card: Closing an old credit card account can have consequences. Closing an account could have a negative impact on your FICO score, the score most commonly used by lenders. That’s because of the way FICO scores are determined, and the complex maze of factors they use to determine whether your score goes up or down. Experian reports that it could hurt your score.

If you need to build your credit from scratch, you must read this article: Building Credit 101

3. Calculate what you can afford

A house is the largest purchase most of us will ever make so it’s important to calculate what your mortgage payment will be and how much you can afford.

You can use our mortgage calculator to have an idea. Be aware however that this estimate doesn’t take into consideration the ratios of your income vs debts which are important factors in the calculation of the mortgage payment.

4. Get pre-approved for a mortgage

Once you decide you want to purchase a home, it is recommended that you get an interview with a loan officer who can give you a pre-qualification letter in a matter of minutes. This meeting will save you a lot of frustrations. Imagine that you go out to look for houses and find THE ONE before getting pre-qualified, then you go to the bank just to realize that you don’t qualify for it. It could be heartbreaking!

Shop for the best deal: You can get the lower interest mortgage with HUD.gov, benefits.va.gov, rd.usda.gov, floridahousing.org. They are going to ask you for:

- Proof of income

- Proof of assets

- Good credit

- Employment verification

- Driver’s license

- Social security.

5. Decide what you want in a home

If you already decided that you want to become a homeowner, you should think about what features are important to you. Here is an example of a list you could make.

6. Chose a Realtor who specializes in the neighborhood

There are a lot of Real Estate agents out there with different levels of experience and expertise. The first step in the entire process is to ensure that you are working with someone who is experienced, competent and sensitive to your needs. Research for the licensing, how long the agent has been in the business, current listings and talk with recent clients.

7. Visit Brickell buildings

There are more than a hundred buildings in Brickell Miami, most of them with more amenities than you could think of. Before scheduling visits to specific units, I recommend my clients to visit buildings that have the characteristics, amenities, location and price range that they are looking for.

For example, is it important that the building is walking distance to a metro station, or is it important that it has a children’s playground? Do you want to be walking distance to schools? Look for schools in Brickell Miami. A real estate agent who really knows the area could answer these questions for you.

8. Narrow choices

After you have a list of buildings that meet your requirements, make appointments to see units in those buildings and compare. Consider resale value, check latest sold units in those buildings and the condos for sale.

9. MAKE AN OFFER

You should be aware of the common contingencies like:

- If home appraises for less than the mortgage.

- If the inspection reveals flaws owner won’t fix.

- If you lose your job before the deal closes.

10. SCHEDULE A HOME INSPECTION

This is a crucial step when you are buying a house. This is not the moment to save! A couple of hundreds could save you thousands in the long run. Have it check by professionals. You can use this checklist to guide you through this process.

11. FINAL WALK-THROUGH

Arrange a walk-through with your real estate agent, at least a week before closing if the condo was rented in which case you want to make sure the tenants didn’t cause any damage while moving out and all appliances and real property are you saw them when you submit the offer.

If the property was vacant, you should do a walk-through the day before closing or even the same day of the closing if it is scheduled in the afternoon.

Ensure the property’s condition hasn’t changed since your last visit, that any agreed-upon repairs have been made and that the terms of your contract (have a contract with you) will be met. Take along a checklist of things to do during the final walk-through, including:

- Test lights, switches, and sockets.

- Check that windows and doors work properly.

- Test drains, faucets and toilets.

- Check the exterior of the home.

- Check all major appliances.

Taking an hour for one last inspection is a good investment in your time. After all, you don’t want to spend the first weeks in your new home cleaning up or making unexpected repairs.

12. CLOSE AND MOVE IN

Enjoy your new home!!!